Prop. 13

Responsible for 50 years of chronic underfunding

Because of Proposition 13, corporations have robbed our public schools and communities of more than 200 BILLION dollars.

How Did This Happen?

47 years ago, a small number of California voters passed Proposition 13. Prop. 13 froze property taxes at 1% of the property purchase price, and was intended to benefit older homeowners.

What many voters then didn’t realize, and many still don’t, is that this property tax cap also applies to corporations. The authors of Prop. 13 sold it as a way to help everyday homeowners, but gave those same tax benefits to huge corporations like Chevron and Disney.

The year after Prop. 13, property tax revenue dropped by a whopping 60 percent.

Those big corporations are still paying 1970s level property taxes. All in, they’re robbing our schools and communities of $17 BILLION every single year.

Reforming Prop. 13 will restore $17 BILLION to our public schools and communities every single year.

San Francisco alone stands to gain $1 BILLION annually.

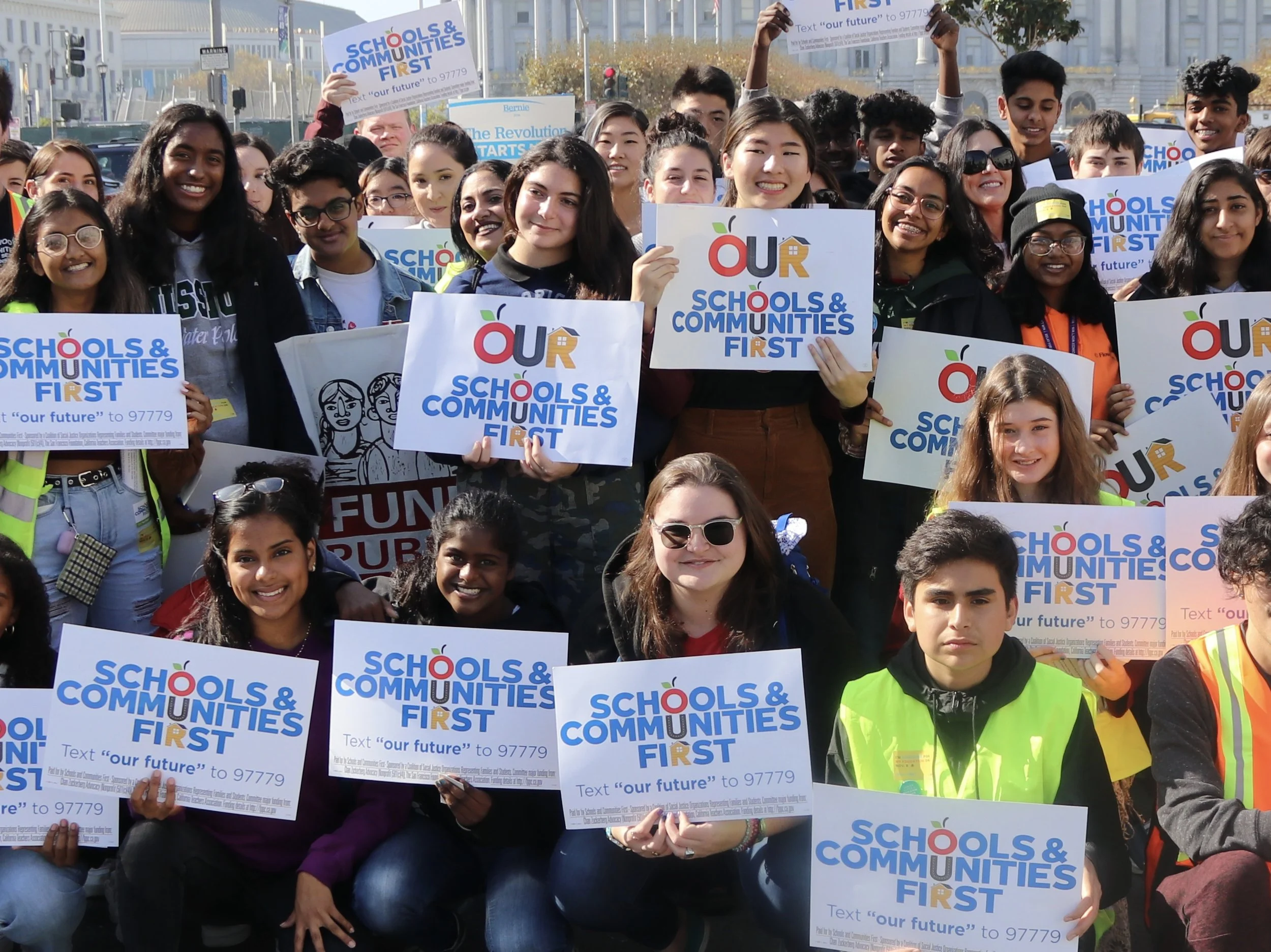

Get Involved with Prop. 13 Reform

Sign the petition to Governor Newsom to insist he vocally support reform in 2026.